Your Guide To Buying Off-The-Plan

September 16, 2020

Buying off-the-plan can be a daunting process and there’s a chance the uncertainty of not being able to see what you’re signing up for might scare you out of the process.

That’s why the team at Loft Haus have developed this guide to help make buying off-the-plan that much easier, by showing you exactly what to expect and hopefully answering any questions you might have when it comes to buying a property off the plan.

Buy now, pay later

Perhaps the biggest advantage of deciding to buy off-the-plan, is the breathing space it can give you for your finances.

Once you’ve settled on a purchase price you are only required to put down a small deposit (typically 10%) and you won’t be required to draw down on a mortgage until within 3 months of receiving your titles, which is usually at the end of construction. In most circumstances, this period can be anywhere from 18 – 24 months giving you ample time in-between to continue saving, organise additional finances, perhaps sell your existing home, or begin buying new furniture.

All the while you can take relief in being able to secure the property you want and not have to pay a mortgage on your new purchase, until you settle.

Set price

The second major benefit of this type of property purchase is that you can time your purchase quite strategically and lock in a price – at the time of your purchase.

As mentioned above, you aren’t required to pay anything more than your deposit up front which puts you in a great position to lock in a purchase price at current market value, before you even need to pay for the purchase at settlement.

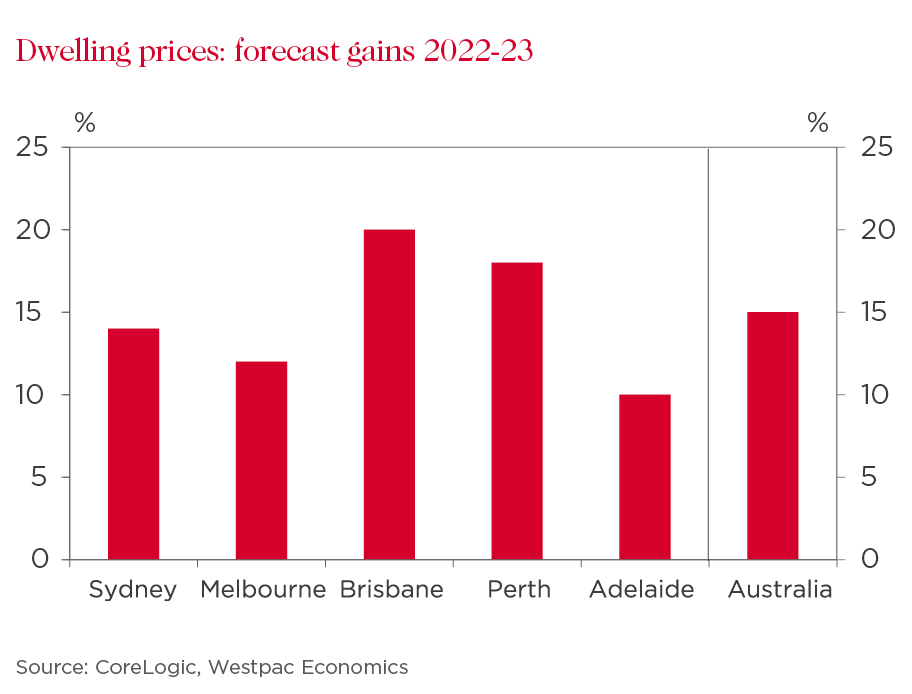

A potential bonus of this, is that if you get in early enough and time your purchase right, you may also see some market growth by the time settlement comes around. The opposite could also happen if you buy at the completely wrong time, so its important that you understand the market conditions before you secure your property.

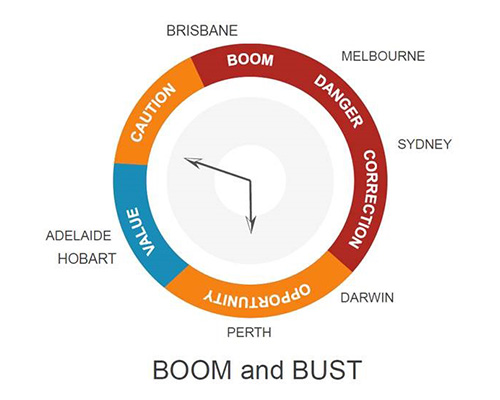

With COVID-19, a mining downturn, low population growth and an over-supply of housing, it’s no secret that the Perth market has been treading water for the past few years. But as an off-the-plan buyer, indicators such as rental demand, supply, low interest rates and price value, are seemingly now pointing to our next major growth cycle.

That means, if you’re purchasing off-the-plan in today’s market, there’s a good likelihood that your off-the-plan purchase may see some capital growth by the time the project is completed and it’s time to move in.

Accessing government grants and concessions

Another benefit of deciding to get in early is having access to State and Federal government grants. Various rebates and incentives are prioritised for buyers and investors who decide to enter pre-construction contracts.

Early buyers in Western Australia can currently access a 75% rebate on stamp duty paid for pre-construction contracts, capped at a maximum of $50,000. Buyers who enter an off-the-plan contract for a development that is under construction can also access a 75% rebate on stamp duty, at a reduced amount of up of $25,000 – with Loft Haus currently under construction, future buyers that sign a contract to purchase before December 31 2020 will qualify for this rebate. Find out more here.

Owner-occupier buyers who decide to enter a pre-construction contract between 4 June 2020 and 31 December 2020, can also access $25,000 via the Australian Government HomeBuilder grant

If you’re a first home buyer, you will also be able to access the First Home Owners Grant of $10,000 for buying or building a new home.

So not only will pulling the trigger early grant you a bigger window to prepare your finances, you will also have access to some fantastic incentives that could potentially save you tens of thousands of dollars.

Brand new property

Loft Haus External Render

Lots of property buyers are purchasing old properties that need a lot of maintenance such as, replacing old plumbing or electricals that you don’t see up front.

What’s more, if you’re buying your first home, you’re forgoing the First Home Owners Grant and letting $10,000 slip through your hands.

When buying off-the-plan, you can take pleasure in knowing you’re the first owner of your brand-new apartment.

Everything inside your property from amenities, fittings, fixtures and included appliances are all brand new, which means they will require zero maintenance for the immediate future.

Most developers also offer a choice of interior colour schemes which means you’ll also enjoy a fresh home decorated exactly the way you want it to be.

What’s more, if you’re a first homeowner, you can utilise the First Home Owners Grant because you’re purchasing a brand-new property.

Buy In A Better Location

If you’re considering upgrading or buying your first home, buying off-the-plan can be a great option to get into an area that you may otherwise be priced out of.

For example, an area like Leederville is a high demand, prime inner-city location that has a median house price of $880,000 (Realestate.com.au, August 2020) and with a development like Loft Haus, you’re able to purchase something brand-new and get a foothold in this area, at just a fraction of the median price.

It also means that you get all the same lifestyle benefits and advantages of this area, as someone that buys a house for $880,000. Whether you’re an upgrader, downsizer, first home buyer or investor, you’ll find this a great financial advantage.

Developer incentives

Developers will often offer some incredible incentives and great deals to encourage buyers to purchase off-the-plan.

This could include things like, furniture packages, low deposits, price guarantees, stamp duty savings and a lot more!

So, you can get the best of both worlds. The option to secure brand-new property with no more to pay until settlement, locking in a great price in the right time of the market – all while getting access to some amazing deals in the market.

Tax depreciation

Of course, as mentioned above buying off the plan means you are buying brand new.

For an investor, this has great advantages because you can claim its depreciation against your tax return.

As you are the original owner of all fixtures and fittings, it means that you’re able to depreciate all of these items, which for an investor, is a substantial income windfall in the first five years or so of owning the property.

The build is also depreciable, which means in addition to the fixtures and fittings being depreciable, the structure of the apartment that houses the tenant that pays you rent, is also tax deductable.

Also, everything you spend on a brand-new apartment generates income for you i.e. there are no wasted funds on a land component that does not generate cash flow for you.

As you can see, if you decide to purchase an off-the-plan apartment as an investment you can potentially benefit from tax deductions valued at thousands of dollars.

Steps To Buying Off-The-Plan

Buying off-the-plan is a relatively stress-free process however having a good idea of where you’re going and what’s coming up next can help ensure you’re prepared and put your mind further at ease.

Here’s our step-by-step guide to making your off-the-plan purchase:

Set A Budget

Before embarking on your off-the-plan purchasing journey you need to get a clear understanding of how much you’re willing to spend.

To be truly satisfied with your decision it’s critical to work within your financial means and you consider a buffer to account for any unforeseen expenses that can arise.

While you will only have to pay a 10% deposit to secure your new apartment, it’s a good idea to know upfront how much money you will be able to borrow to help guide you into the right apartment in the right development.

Conducting Research

Anytime a substantial purchase decision needs to be made it’s essential to do your research.

To make an informed decision you need to commit the time to learn about the suburb that you’re interested in moving into. You don’t need to become an expert, but you should have a clear idea of where your potential off-the-plan purchase fits into the market landscape.

Consider researching the developer and builders behind a project too. Gain an understanding of other projects they have completed and the quality to which they’ve delivered them.

Doing so will give you the confidence in knowing that you’re making the right decision and that your money will be spent well.

The team behind Loft Haus including Griffin, Carrier and Postmus Architects and The ABN Group all have an exceptional track record and a well-established name throughout Western Australia and across Australia.

Meet With Your Dedicated Project Sales Manager

Once you find the property you like, you can typically request a free consultation to discuss your needs and wants so that they can help you find the right floor plan configuration.

Depending on the project this might also be an opportunity for you to see the development site and get a feel for your new future postcode.

If you’ve been looking at Loft Haus, go here to request your free consultation and our projects team will answer all of your questions around apartment availability, designs, financing, how off-the-plan buying works and government support to help you navigate the process of determining if buying off the plan is for you.

Getting in early

Buying off-the-plan means that you get to choose from a selection of apartments before they’re built. If you get in early enough, you’re able to select from a range of floor plans configurations and even choose your colour scheme options to suit your style.

Getting in early has many perks including:

✔️ Choosing your most desired floor plan configuration

✔️ Choosing your most desired orientation to maximise liveability or if you’re more of a views person, you will get first dibs to choose what kind of view you want to wake up to every morning.

✔️ Locking in a great purchase price – as mentioned above, if you buy at the right time of the market at a great price point, you could possibly see some capital growth by the time you move in, which would be a nice bonus. Of course, the opposite could happen if you don’t get your timing right.

Sourced from Real Estate Central

✔️ Getting in early also means that you have more time to get your finances organised, before you have to draw down on your mortgage. You’ll find this a great advantage if you want to save more money or if you need to sell your existing home before moving into your new apartment.

As you can see, there are a few key benefits of getting in early that can make a huge difference to your lifestyle and finances.

Select Your Preferred Apartment

Now it’s time to decide on which apartment you want.

Purchasing off-the-plan means you’ll be presented with a selection of different floorplans and configurations based on bedroom and bathroom preferences.

For example, at Loft Haus, you can choose from a total of 15 residencies and 2 contrasting colour schemes. Apartments range in bedrooms, bathrooms and even front and rear-facing views.

Choosing your preferred apartment is highly dependant on how early you get in so if you want to maximise your chances of finding an apartment that fits your ‘ideal’ criteria, don’t delay on placing an apartment on hold while you decide if the purchase is right for you.

Reserve Your Apartment

Once you’re happy with your choice of apartment, it’s time to reserve it. The project sales team at your development will walk you through the process of reserving your apartment and finalising contracts.

Typically, you will be required to process a reservation fee to secure your apartment which is refundable until the final exchange of contracts. The reservation fee ensures that the apartment you’re interested in can be held for you and strictly prevents others from buying it.

Check What Grants and Rebates You Can Access

State and local governments are currently doing their best to help investors, first home buyers and second time property buyers get into off-the-plan properties and new builds.

Give yourself a good window of time to familiarise yourself with what you’ll be able to access and note what’s available to you, as this will differ from state to state.

Timelines will differ for every grant so it’s critical you give yourself ample time to investigate your eligibility and begin application processes. Go here to find out more about what grants and subsidies you can access here in Western Australia.

Finalising Your Contract

You’ve done all the hard work – it’s time to make it official. This part of the process is where you formally confirm the terms and conditions of your contract and pay your deposit to secure your selected apartment.

Here you are typically required to pay a deposit to the value of 10% of the total purchase price, while the balance of the full purchase price won’t be due until settlement, when the building is complete. That means between this stage and settlement you have nothing more to pay. It’s important to note here, that many developments will not have the option of refunding your deposit if you simply change your mind, so make sure you’re aware of the deposit requirements before you sign your contract.

Similarly, to all contracts, it’s vital that you understand exactly what you are signing. Take the time to thoroughly review your contract and if required seek independent legal advice.

Prepare Your Finances

You will be required to start organising your finances 3 months out from the completion of the development, ensuring that you have finance approval for the apartment and starting the process of applying for your mortgage with your broker. At this stage, make sure that you have a concrete understanding of the grants you can access and that your broker has organised your applications, before it comes time to settle on your apartment.

If you’ve been looking at Loft Haus and you would like to understand your lending capacity and required budgets, get in contact with our project management team here and we can organise a free appointment with our in-house finance team to discuss your situation.

Pre-Settlement

Upon building completion, you will be invited to a pre-settlement inspection. During the pre-settlement inspection, you are granted an opportunity to view the finished apartment and ensure the premises meets your expectations. This is your opportunity to highlight any defects with the internals of the property where the construction team can resolve before you move in.

Settlement Completion

After your successful pre-settlement inspection, the final step in this process is completing the settlement. At this point, your chosen financier and solicitor will likely do most of the organising and your main priority will be getting your signature right and organising your move in.

During this final step, you’ll also have the excitement of receiving keys to your brand-new apartment!

Some Great Options Available

If a vibrant lifestyle close to great entertainment, retail, parks, transport links and the CBD is something you would be interested in, then there’s some excellent options around to suit your property needs.

Right now, the latest development in Leederville is taking shape and is ideal for you a boutique lock and leave lifestyle, in an amenity rich location is something important to you.

Loft Haus is a well-located apartment development, as anyone familiar with the suburb of Leederville would know. The inner-city location is a very established urban area that puts you just minutes from everything including cafes, restaurants, supermarkets, schools, parks, transport links and an abundance of recreational facilities.

Loft Haus itself some incredible features including spacious 2 and 3 bedroom floor plans, dual aspect orientations, lush leafy green communal spaces, spectacular city-views and incredible scandi inspired finishes throughout.

Construction is underway at Loft Haus, which means right now you could purchase off-the-plan meaning just a deposit to pay now and no more to pay until completion which is expected 2022.

Loft Haus – Living, Dining & Kitchen Render

Access Up To $35,000 Worth of Incentives

Loft Haus currently qualifies for the 75% Stamp Duty rebate scheme up to $25,000. Combine this with the additional First Home Owner Grant up for grabs and you can access to up to $35,000 worth of savings to get into one of these boutique inner-city apartments.

What you could access

$10,000 First Home Owners Grant

Who qualifies: First Homebuyers.

75% Stamp Duty Rebate up to $25,000

Who qualifies: First Homebuyers, Owner Occupier buyers and Investors.

Backed By An Experienced Off-The-Plan Team

The project management team at Loft Haus are made up of some of Perth’s leading off-the-plan experts that work with property buyers from start to finish to ensure your risks are minimised and your experience is seamless and stress-free. Our team includes the expertise of Griffin Group, Abel Projects WA and The ABN Group – collectively we take pride in delivering quality products and a great experience for you as a buyer.

As you can see deciding to buy off-the-plan can derive some incredible financial and personal benefits and involves a relatively straight forward process. If you’d like to discover the range of apartments currently on offer at Loft Haus or would like to know more about the buying off-the-plan process, we encourage you to contact us today.

Our friendly project management team will be more than happy to answer any questions you might have and help you find the perfect boutique apartment in Leederville for you.