COVID-19 and the property market

March 30, 2020

With unpredictability around the ongoing pandemic COVID-19 and the potential onset of a recession there is some uncertainty around property values. The good news is that history has shown that the housing market performs relatively well with economic shocks compared to the share market according to CoreLogic’s head of Australian research Eliza Owen.

Ms Owen also commented on the housing market being ‘far less volatile’ than share markets, with a view that coronavirus would not cause a major collapse in pricing although there may be a decline in property transactions.

To read the full article from Realestate.com.au , click here.

Read Our Other Articles

Property prices surge creating a rush to build

Developers have been pushed to start bidding for housing project sites again in Melbourne and Sydney as the annualised...

WA IS SAILING THROUGH THE ECONOMIC STORM

The State Governments hard border closure, the ongoing strength in the mining sector and the states low reliance on...

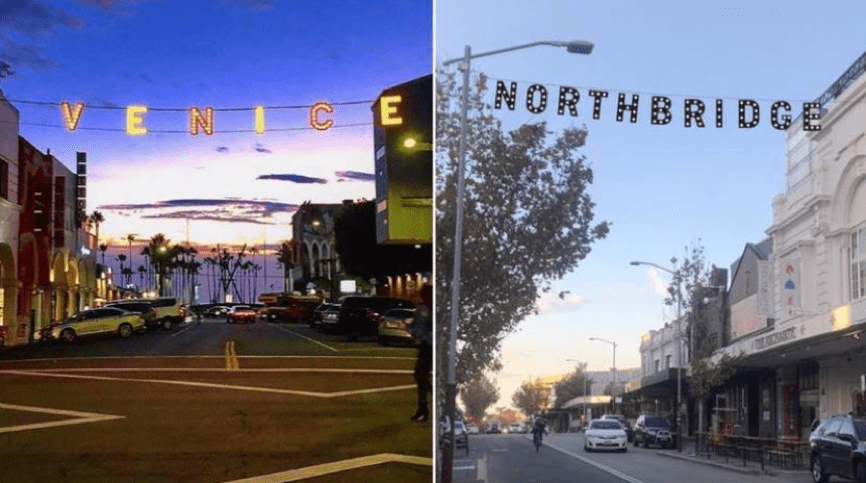

Venice Beach inspired sign set for Northbridge

Northbridge, the city’s entertainment hot spot, as part of a $1 million revamp is set to get its own...

Critical minerals put WA on the map

A previous post covered the USA’s interest in WA’s critical minerals. https://griffin-group.com.au/news/potential-usa-trade-deal-to-create-6000-jobs/ Another recent article in The West touches...

Adelaide property market still climbing despite COVID-19

Adelaide is one of three cities across the country where property values are continuing to climb despite the nationwide...

Demolition completed

In an important step for The Residence development, demolition on the Scarborough site has officially been completed. In keeping...

Adelaide’s resilient property market

Promising news for Adelaide despite COVID-19 fears of an economic decline as new research from Property Investment Professionals of...

Clearing the way for Reside on Money

It has been an action packed week on Money Street, with an excavator on site demolishing the old house...

PROPERTY MARKET THRIVES DESPITE THE IMPACTS OF COVID-19

New land sales are at a record high according to recently released figures from UDIA WA, following the announcement...

WHY APARTMENT LIVING IS BECOMING MORE POPULAR

Traditionally, living the Australian dream involved ownership of a single storey home, on a quarter-acre suburban block with a...